Receivable Financing

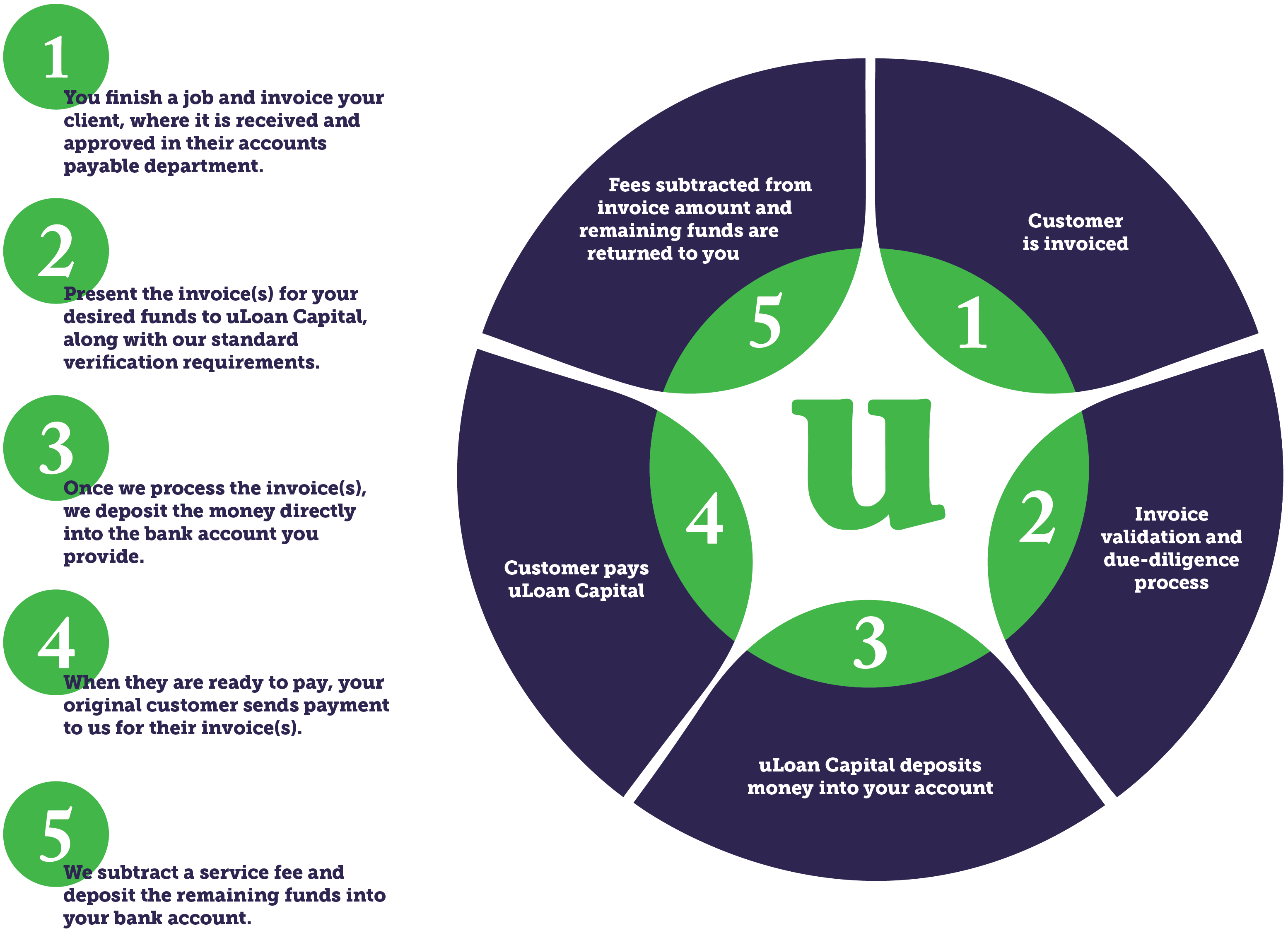

Invoice financing is a way for businesses to borrow against the amounts due from customers. Invoice financing helps businesses improve cash flow, pay employees and suppliers, and reinvest in operations and growth earlier than they could if they had to wait until their customers paid their balances in full.

Contact Us